How To Find Dividend Of A Stock

What is a Stock Dividend?

A stock dividend, a method used past companies to distribute wealth to shareholders, is a dividend payment fabricated in the form of shares rather than cash. Stock dividends are primarily issued in lieu of cash dividends when the company is low on liquid cash on hand. The lath of directors decides on when to declare a (stock) dividend and in what grade the dividend will be paid.

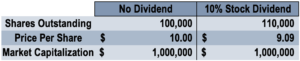

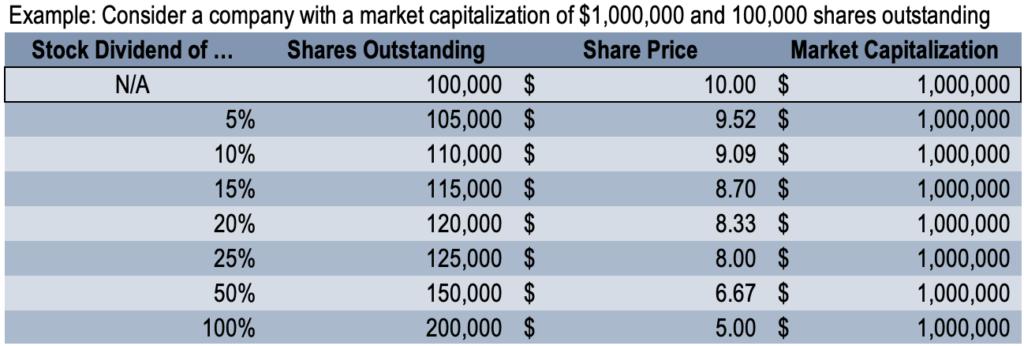

Impact of a Stock Dividend on Market Capitalization

Similar to a cash dividend, a stock dividend does not increase shareholder wealth or market capitalization . Although it increases the number of shares outstanding for a visitor, the price per share must subtract accordingly. An understanding that the market place capitalization of a company remains the same explains why share price must decrease if more shares are issued. The following diagram illustrates the concept:

Example of a Stock Dividend

Colin is a shareholder of ABC Company and owns 1,000 shares. The board of directors of ABC Company recently announced a x% stock dividend. Assuming that the current stock price is $x and there are 100,000 total shares outstanding, what is the effect of a ten% stock dividend on Colin's one,000 shares?

1. Determine the market place capitalization of ABC Company:

$10 ten 100,000 shares = $1,000,000 (marketplace capitalization)

ii. Determine the increase in shares outstanding due to a 10% stock dividend:

100,000 shares x x% = x,000 increment in shares outstanding

iii. Decide the new total shares outstanding:

10,000 + 100,000 = 110,000 shares

4. Make up one's mind the number of shares Colin at present owns:

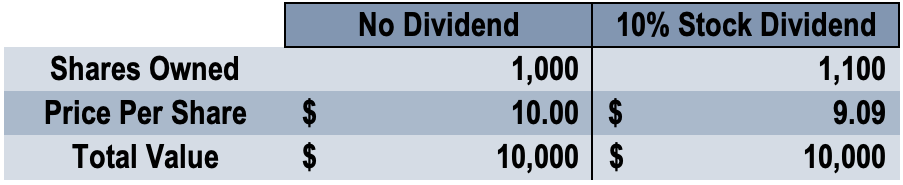

Before the stock dividend, Colin owned 1% (i,000 / 100,000) of the total outstanding shares. Since a stock dividend is given to all shareholders, Colin's ownership percentage in ABC Company remains the same.

Therefore, Colin would own one% of the new total shares outstanding or ane% x 110,000 = 1,100. The number is identical to increasing Colin's 1,000 shares past the ten% stock dividend.

5. Determine the price per share of ABC Visitor:

A stock dividend does not increase the market place capitalization of a company. The market capitalization of ABC Company remains $1,000,000. With 110,000 full shares outstanding, the stock price of ABC Company would exist $1,000,000 / 110,000 = $9.09.

The following diagram illustrates the impact of a stock dividend on Colin:

The following diagram illustrates the impact of a stock dividend on ABC Company:

The primal takeaway from our example is that a stock dividend does non affect the total value of the shares that each shareholder holds in the company. As the number of shares increases, the price per share decreases accordingly because the marketplace capitalization must remain the same.

Advantages of a Stock Dividend

1. Maintaining cash position

A company that does not accept enough cash may choose to pay a stock dividend in lieu of a cash dividend. In other words, a cash dividend allows a visitor to maintain its current cash position.

two. Tax considerations for a stock dividend

No tax considerations be for issuing a stock dividend. For this reason, shareholders typically believe that a stock dividend is superior to a cash dividend – a cash dividend is treated equally income in the twelvemonth received and is, therefore, taxed.

3. Maintaining an "investable" price range

Every bit noted to a higher place, a stock dividend increases the number of shares while too decreasing the share price. Past lowering the share toll through a stock dividend, a visitor'south stock may be more "affordable" to the public.

For instance, consider an investor with $1,000 looking to invest in Stock A or Stock B. Stock A is priced at $ii,000 while Stock B is priced at $500. Stock A would exist deemed "unaffordable" for the investor since he only has $1,000 to invest.

Disadvantages of a Stock Dividend

1. Marketplace signaling and disproportionate information

The market may perceive a stock dividend as a shortage of cash, signaling financial issues. Market place participants may believe the visitor is financially distressed, as they do not know the bodily reason for management issuing a stock dividend. This tin can put selling pressure on the stock and depress its price.

two. Risky projects

Issuing a stock dividend instead of a cash dividend may signal that the company is using its cash to invest in risky projects. The practice can bandage doubt on the visitor's direction and subsequently depress its stock price.

Journal Entries for a Stock Dividend

The journal entries for a stock dividend depends on whether the company is involved in a small stock dividend or a large stock dividend. The journal entries for both sizes are illustrated below:

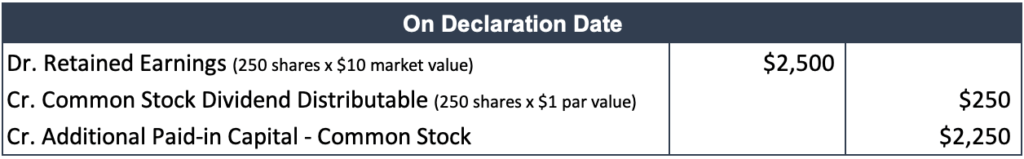

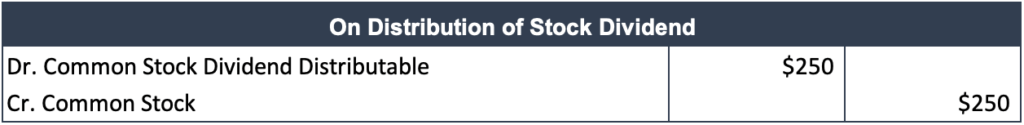

1. Modest dividend

A stock dividend is considered a modest stock dividend if the number of shares existence issued is less than 25%. For case, assume a visitor holds 5,000 common shares outstanding and declares a 5% common stock dividend. In add-on, the par value per stock is $1, and the market value is $x on the declaration date. In this scenario, 5,000 ten v% = 250 new common shares will exist issued. The following entries are made:

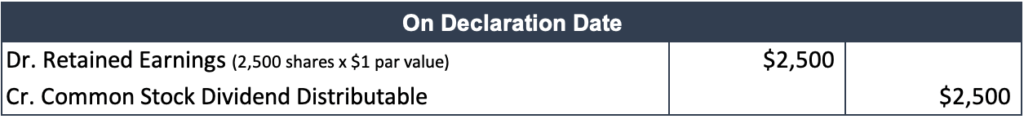

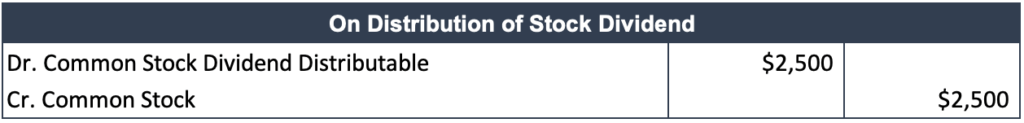

2. Large dividend

A stock dividend is considered a large stock dividend if the number of shares existence issued is greater than 25%. For example, assume a company owns 5,000 common shares outstanding and declares a 50% common stock dividend. In addition, the par value per stock is $ane, and the marketplace value is $10 on the declaration engagement. In such a scenario, v,000 x 50% = ii,500 new common shares will exist issued. The following entries are fabricated:

More than Resources

Give thanks you lot for reading CFI'southward guide to Stock Dividend. To keep advancing your career, the additional CFI resource below will be useful:

- Capital Gain

- Free Float

- Special Dividend

- Weighted Boilerplate Shares Outstanding

Source: https://corporatefinanceinstitute.com/resources/knowledge/finance/stock-dividend/

Posted by: hiebertclould.blogspot.com

0 Response to "How To Find Dividend Of A Stock"

Post a Comment